What is a Good Credit Score and Credit Score Range?

What is a Good Credit Score and Credit Score Range?

Credit Report and Credit Score is used to check the creditworthiness of a person. A credit score range is based on the data provided by the credit report that indicates payment history, accounts, etc. Today many lenders and retailers take the help of credit reports and credit scores to lend credit. Credit report and credit score help the bank lenders to judge the creditworthiness of a person at the time of allotting him credit.

A person with a bad credit report and score find it difficult to raise the credit whereas the person with good credit score and report does not face any financial stake. The credit report and score provides a true picture of a person’s financial position. But it is the initiative of an individual or financial institution to ask for it. This credit report and score are provided by the credit bureau within a few days of your request.

It is advisable that every person must understand his/her credit report. Initially, the law prohibited for its disclosure but later on it was made available on request. It is vital that one should check his/her credit score and report any errors found. Remember a small error in your credit score can harm your credit report in a big way.

But what is a good credit score?

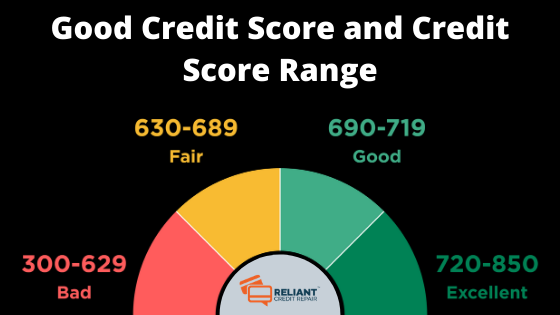

Well, credit score differs from person to person and is determined by a lot of factors. Generally, credit score ranges from 300-750 but many people have their credit score within 600-750. If you are thinking if 750 is a good credit score, let us tell you that in business terms, a score above 700 is regarded as an excellent credit score.

Having a good credit score can benefit you in multiple ways, including your credit limit, loan capacity, and more.

Why Check Free Credit Report and Score?

Checking Credit Card does not harm your credit score. Checking removes the bad remark in your credit report and similarly in the credit score. It indicates your financial position in the business. Regular updating of credit report also helps to rectify any major financial error. If you find any error or mistake in your credit report assure that you rectify it immediately.

How can you get your Credit Score?

It is true that the credit score is totally based on the content in the credit report. As the content in credit report varies there is variation in your credit score. If your FICO rating doesn’t fall between the good credit score range, you should work to improve it. It is possible to view your credit report online just by requesting it. The credit report and credit score that you get through these online services do not cost much.

Source: Credit Report and Credit Score

More References

A Crash Course On Credit Scores

How to Evaluate and Raise Your Credit Score

Easy Steps To Maintain A Good Credit Score