Is Your Credit Rating Grating?

Your credit rating is quite an important piece of recorded history. It tells something of…

Your credit rating is quite an important piece of recorded history. It tells something of…

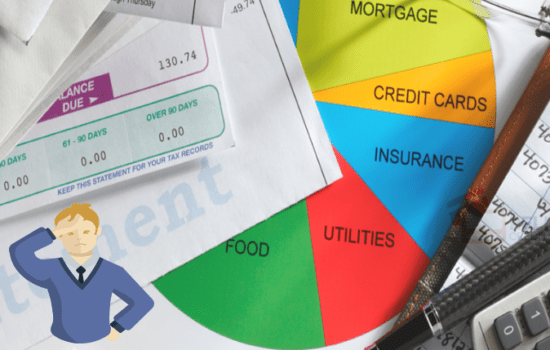

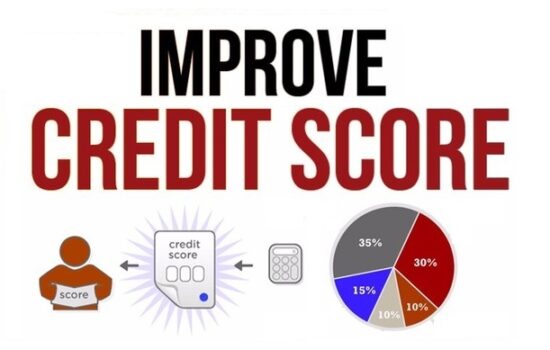

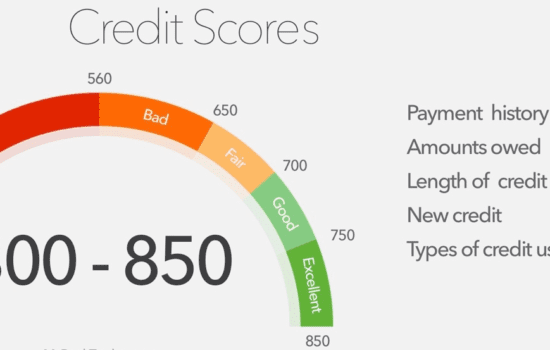

What does “Credit Score” mean? A measure of credit risk calculated from a credit report…

Bad credit, credit cards are just like regular credit cards but with much higher interest…

For the millions of consumers with bad credit and no credit, getting approved for a…

Does Credit Repair Really Work Credit card issuers and lenders always review credit reports of…

The Fair Credit Reporting Act (FCRA) and the recent update to this law called the…

Although the vast majority of adult Americans (and many minors, as well) have some kind…

Having a copy of your credit score can most often mean the difference between going…

A credit report is a document that outlines your financial status, specifically your credit history….

Getting pre-approved for bad credit car financing will help you get the best rates possible….

Get Social