Credit Score Repair – The Higher Your Score, The Better For Your Credit

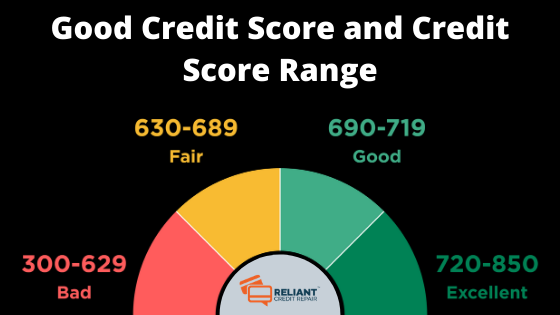

Credit Score Repair – The Higher Your Score, The Better For Your Credit Credit score repair means that you want to take steps to improve the credit score you have on your credit report. A good credit score means that creditors see you as a good risk to repay the