What Is a Bad Credit Score: Check Your FICO Rating

The vast majority of people have a somewhat hunch about their credit – it’s either awesome, great, or too awful. Yet, what is a bad credit score in real? To start with, it’s essential to comprehend that there are various credit scoring models out there and each may utilize an alternate scale to judge – or numbers – to pass on data.

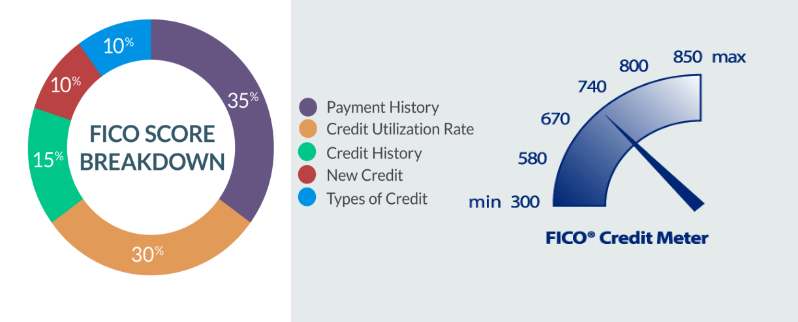

All things considered, in the loaning scene, there are a few suppositions that can be made about FICO assessments that fall into various reaches — and, in that capacity, what score may qualify as “bad credit score“. For example, most real credit scoring models take after a 300 to 850 range, where the lower your score, the worn out. Yet more on this in a moment and, while you’re taking a look at a score measured along these lines, you can, by and large, accept anything underneath 600 is an awful FICO score for you.

Here are credit scores limits with their types to help you understand better:

750+ = Excellent Credit

700-749 = Good Credi

650-699 = Fair Credit

600-649 = Poor Credit

600 and Below = Bad Credit

How about we take a more profound look to make a plunge in what is a bad credit score.

How is a Bad Credit Score Decided?

As said above, FICO rating extents can differ by demonstrating. For instance, all FICO scores extend in the vicinity of 300 and 850 with 300 being the least (or most noticeably bad) conceivable score, while 850 is the most elevated (or best) conceivable score.

Presently, the organizations that create financial assessments – are FICO and VantageScore, for instance – don’t choose which FICO ratings are actually “great” or what is a bad credit score for you. Nor do the credit revealing offices that supply the credit reports used to make FICO ratings. Rather, it’s up to singular loan specialists and insurance agencies who utilize these scores to choose which scores show an adequate level of hazard for them. They utilize scores in an assortment of ways, as well.

In reality, there’s nothing called bad credit score since the number means nothing in itself. It is only until the point when any creditor decides how to utilize it. At the end of the day, a FICO assessment is just terrible when you can’t do something that you want to just because your rating is low, no matter if that is to renegotiate an advance, acquire something at a lower loan cost, or getting the best arrangement on your accident protection.

Besides, what is a bad credit score for one moneylender might be consummately adequate to another.